Mexico is seeking to increase the militarisation of civilian activities, ranging to national park to domestic anti-crime operations, with a plan under the premiership of President López Obrador to bring the country’s National Guard under military control.

“Troops have run over 2,500 branches of a state-development bank, constructed a new airport in Mexico City, and run various customs centres,” says Madeline Wild, associate defence analyst at GlobalData.

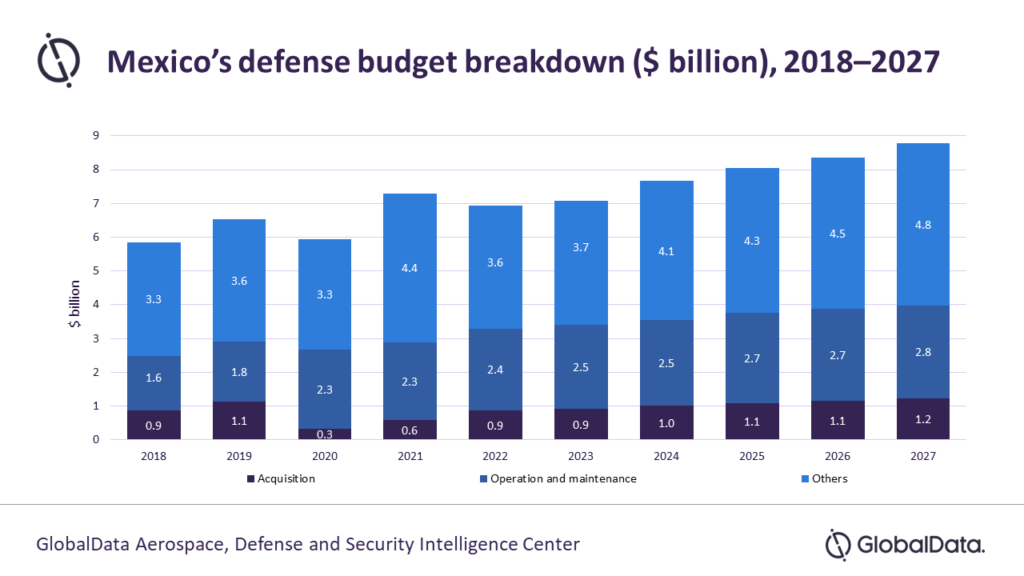

Mexico’s defence budget is now expected to grow from $6.9bn to $8.8bn by 2027, according to GlobalData. “These activities all require funding, thus driving continued growth in the defence budget,” continued Wild.

Military control extending

In a state-of-of-the-nation address on 1 September, Obrador outlined plans to further empower Mexico’s military authority, asking Congress to transfer control of the National Guard away from citizen control and into military command structures.

The National Guard was created in 2019, the same year the Mexican constitution was changed to allow the President to use the military in various roles to support the civilian authorities. Removal of civilian control of the National Guard would be contrary to Mexico’s constitutional structure and Obrador does not have the votes to make constitutional change, rather seeking a simple majority to pass a motion making the change.

There is significant public support for participation of the country’s armed forces in the fight against the drug cartels, with a La Nación poll indicating 80% of the public are in favour of their role combatting organised crime.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

GlobalData’s latest report, ‘Mexico Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-2027’, notes that Mexico’s defence industry will showcase a positive compound annual growth rate (CAGR) of 5.5% between 2023 and 2027, which is a faster rate of growth compared to the 2018-22 period, which saw a positive CAGR of 4.4%.

Mexico’s defence industry benefits from a close relationship with the US

The US and Mexican defence industries have long been intertwined; the resolve of their cooperation tested recently by political change in both states. Mexico and the US had both been deeply involved in the Merida Initiative, an agreement aimed at strengthening the rule of law and providing funding for counter-narcotic operations.

However, political tensions between the administrations of López Obrador and US President Joe Biden are making many question the viability of this arrangement. A successor to the Merida Initiative is still uncertain while the original deal approaches its date for renewal.

“Counter-narcotic and anti-organised crime operations under the Merida Initiative had been key drivers of Mexican defence spending. The decline of these will impact the division and allocation of defence funds,” says Wild, who believes Obrador’s unconventional use of the military will counterbalance operational funding requirements.

While Mexico may have seen a reduction in financial and operational cooperation with the US Department of Defense, Maquiladora Investment Incentives in Mexico (IMMEX) may still benefit the industrial relationship.

“Unless relations decline substantially enough to threaten USMCA, this beneficial relationship looks set to stay.”

IMMEX offers vast reductions on various taxes and significantly reduces barriers to trade. As an example, Mexico imports raw materials tax free with an assurance they are then exported later as manufactured goods.

Wild continues: “Mexico’s defence industry benefits from a close relationship with the US due to the large presence of US firms operating in Mexico under IMMEX rules.

“Manufacturers benefit from cheap labour costs and fewer regulations when carrying out manufacturing procedures on Mexican soil, whilst Mexico gains knowledge transfers, a greater industrial skills base, and an increase in the operations of smaller Mexican firms that may have the opportunity to engage in the supply chains of US firms operating in Mexico.

“The IMMEX programme is compounded by the US-Mexico-Canada Agreement (USMCA, the NAFTA successor). Thus, unless relations decline substantially enough to threaten USMCA, this beneficial relationship looks set to stay.”