Following the successful year-long trial of a Laser Weapon Demonstrator (LWD) onboard the German Navy frigate FGS Sachsen (F124) last month, the Bundeswehr has asked for more challenging requirements to be met in developing the future High-Energy Laser (HEL) weapon system.

Working together as part of the High-Energy Laser Naval Demonstrator Group, abbreviated in German as ‘ARGE’, MBDA was responsible for producing command and control as well as the target-tracking capabilities, while Rheinmetall manufactured the laser power source, beam directors, and other niche internal components.

At an international press event at MBDA Germany’s Schrobenhaussen facility last week, Doris Laarmann, the company’s head of laser business development, discussed the latest requirements as well as the innovative approaches taken to effectively track targets using its sophisticated sensor suite and command and control (C2) interface.

A brief look at the Directed Energy Weapons (DEW) market

HEL systems engage targets at the speed of light, with very low optical detectability, while operating with the highest possible precision and minimal collateral damage.

Leading intelligence consultancy GlobalData suggests the DEW market presents significant potential for growth due to rising global demand and extensive opportunities for technological innovation.

According to GlobalData, Germany has spent $195m (€183.1m) on DEW systems to remain invested in the market potential. However, the Bundeswehr is more cautious with its research and development (R&D) efforts, which explains why MBDA’s LWD project was entirely self-funded.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNevertheless, the low cost per engagement will certainly balance the net cost of conventional missile systems throughout their lifecycle – accounting for supplementary equipment and projectiles.

Right now, this has not stopped increased global spending on conventional missile programmes, including the Ground Based Strategic Deterrent, Patriot Advanced Capability-3, Indirect Fire Protection Capability Increment 2, SM-6 block 1, and the Next-Generation Interceptor programmes by the US.

Bundeswehr’s requirements and the future of lasers

At the press event, Laarmann explained the various stages of laser weapon system (LWS) development.

MBDA Germany achieved proof of concept in 2008, developed the critical technologies needed for the system in 2010 and her team has lately demonstrated the system in an operational environment against land, air and sea targets.

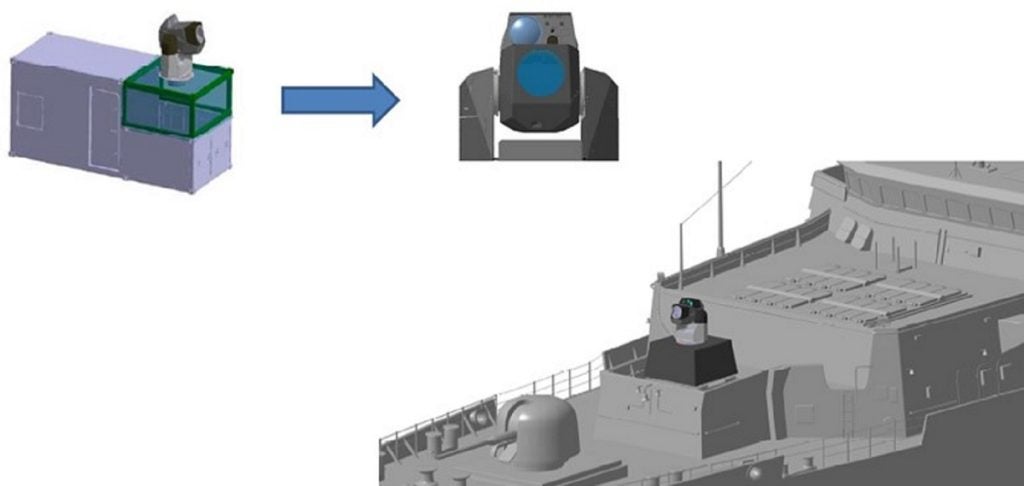

Although the technology is ready, the Bundeswehr requires a smaller, integrated and modular system as opposed to the 20ft, six and a half tonne container unit that was on board the German Sachsen frigate this past year.

MBDA Germany expects to fulfill these additional developments by 2027+.

Moreover, the German Armed Forces want a LWS that is more powerful – with the ability to engage more difficult targets such as drone swarms. Currently, the LWD’s beam operates at 50-100kw, which requires a three-to-five-second engagement time to destroy a target.

“Lasers are a compliment to missiles. They will not surpass them [right now],” Laarmann stated.

When asked whether the defence industry will eventually transition toward greater use of LWSs compared to conventional projectiles, Laarmann explained that this “depends” on the intensity of the laser beam.

“At the moment we are on 50-100kw,” but this “could eventually surpass at the level of megawatts, whereas now we are on kilowatts.”

If this this is the case, then it will not be for some time considering the simultaneous advancement and reliability of conventional missiles.

Emerging concepts for increased manoeuvrability are entering the missile defence market, such as the low-radar cross section missiles operating at hypersonic speeds, which GlobalData says will alter the present-day paradigm for the detection and defensive countermeasures of assets, in turn driving R&D investments into missile defence systems.

Right now “we are still a missile company,” Laarmann reiterated.