Over the course of the last several years, the use of low-cost unmanned aerial solutions (UAS) or ‘drones’ as both surveillance and precision strike platforms on the modern battlefield has evolved dramatically.

Emerging first as an innovative guerilla warfare tactic employed by non-state actors such as the Islamic State in 2015, the use of repurposed consumer drone technology for military applications has evolved into an increasingly popular operations concept, with a growing number of military organisations and state actors now investing in low-cost unmanned aerial vehicle swarming technology (Locust).

As illustrated frequently from footage of the ongoing conflict in Ukraine, civilian drone technology can be easily adapted into precision strike solutions by leveraging conventional explosives such as grenades and rockets, a concept which has proven particularly challenging due to the inherent difficulty in tracking and eliminating these drones in a contested battlespace.

Though the survivability of these platforms is demonstrably limited, with reports having assessed an attrition rate of approximately 10,000 drones per month for the Ukrainian armed forces, both the Ukrainians and the Russians have only expanded their use over time as their cost-to-benefit ratio remains far more favourable than that of comparably more expensive or less accurate equipment.

As the Chinese commercial drone industry continues to expand as growing global interest drives investment in the country’s manufacturing sector, major players such as the US military have become increasingly concerned regarding the prospect of their forces being targeted by large groups of such low-cost drones conducting swarming attacks.

Swarming has become an increasingly common tactic, as the ability to overwhelm countermeasures or air defences using a large number of strategically expendable UAS systems is proving a challenge for even the most advanced kinetic air defence solutions.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe US Department of Defense recently launched its Replicator low-cost UAS manufacturing initiative, further illustrating the rising importance of quantity over quality in the UAS market.

This in turn has driven a commensurate revolution in the development of Counter-UAS (C-UAS) systems, with companies increasingly focused on the cost-efficiency of their products.

One emergent trend has been the development of ‘reusable interceptor’ UAS platforms which leverage their inherent mobility to collide with and destroy hostile UAS threats.

Though these interceptor systems are hardened to enhance their survivability and facilitate multiple uses of the same interceptor, they remain much cheaper than conventional missile interceptors and consequently provide a more cost-effective solution in the long term.

However, even these systems may face challenges when countering Locust, as single-use drones and basic loitering munitions would still be cheaper to mass produce and consequently enable attacking entities to outnumber the interceptors.

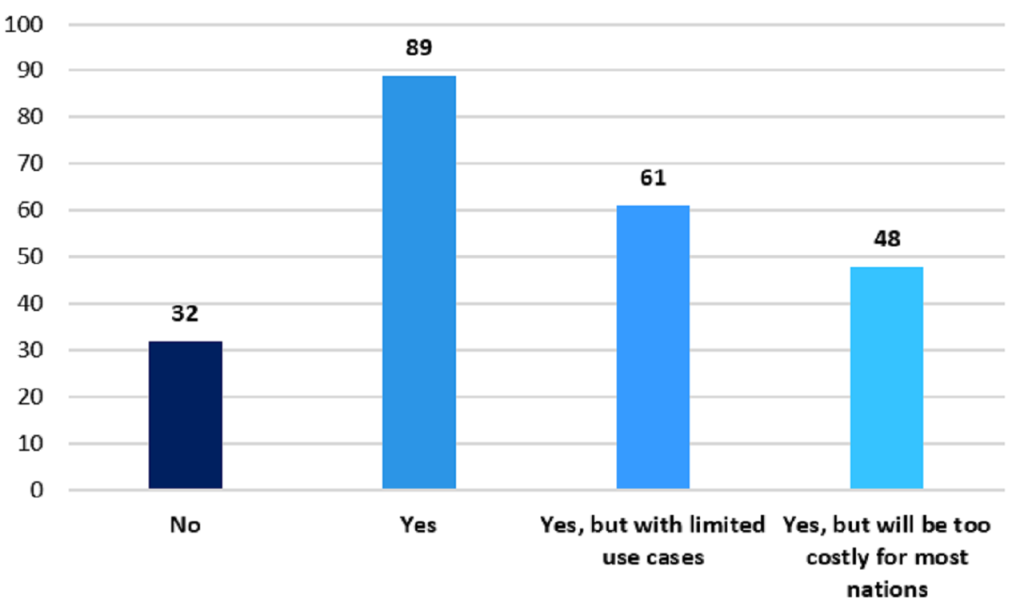

Concerns remain regarding the continued imbalance between the capabilities of low-cost drones and the countermeasures available in the C-UAS market, with a public poll conducted by GlobalData in August 2023 indicating that a majority of respondents believed innovations within the drone market will continue to outpace C-UAS solutions.

As these concerns continue to mount, one emerging segment of the global C-UAS solutions market is attracting growing levels of investment from around the world: directed energy weapons (DEW).

Defined by the US government as “systems utilising concentrated electromagnetic energy” (as opposed to kinetic energy) in order to “incapacitate, damage, disable or destroy a target”.

These systems offer a number of technological benefits that may prove critical in effectively countering the threat posed by the emerging Locust concept.

Due to their reliance on electric energy, DEWs possess a ‘deep magazine’ of nearly unlimited supply, reducing the logistical burdens and costs of keeping systems supplied with ammunition and thus reducing interception costs over the short and long term.

There are several types of DEWs on the market today, with the two primary categories being laser weapons systems (LWS) and high-powered microwave weapons (HPMW), both of which possess unique characteristics beneficial to the C-UAS sector.

LWS, the most common type in current use, functions by projecting laser beams on their targets to generate a range of effects depending on the laser’s strength.

High-energy lasers of around 100kW can generate sufficient thermal damage to small airborne targets to disable or even destroy them, making them an attractive C-UAS solution due to their high rate of accuracy and low per-shot cost.

Other acquisitions such as the US Navy’s High Energy Laser and Integrated Optical-dazzler with Surveillance (developed by Lockheed Martin) or the US Army’s Directed Energy Maneuver Short-Range Air Defense system (produced by RTX) illustrate the growing interest and investment within the field of LWS from the US Department of Defense, which is indicative of the growing level of confidence military institutions are placing in laser weapons technology to counter the threat of drone swarms.

HPMWs are the second most common type of DEW and function by creating electromagnetic beams of microwave radiation, which due to their increased energy dispersal are effective against a larger number of targets but at shorter ranges.

This is particularly beneficial in the C-UAS domain as HPMW systems can effectively disrupt all electronics within a designated airspace almost simultaneously, thus increasing the speed at which an entire swarm of drones can be disabled.

In 2020, the US Air Force (USAF) spent $16.28m on a single prototype HPMW system dubbed PHASER (developed by RTX), which was then deployed at an overseas US military installation for further experimentation and field testing.

The USAF has since invested additional funds in programmes exploring the use of HPMWs to counter drone swarms, having awarded $22m to Leidos in 2022 to develop the Mjölnir system, an upgraded variant of the Tactical High-power Operational Responder system it had first acquired in 2019.

The US military in particular has expanded its investments in the field of HPMWs lately, with the latest major contract award being a $66.1m deal to acquire the Leonidas C-UAS solution from specialist company Epirus as part of the Indirect Fire Protection Capability – High Power Microwave programme for the US Army.

With these mounting levels of investment and development activity, the level of public confidence in the utility of directed energy weapons as an effective C-UAS solution has become increasingly apparent.

In another public poll conducted by GlobalData in September 2023, the vast majority of respondents said they expected directed energy weapons to proliferate as a major disruptor within the wider C-UAS market, though a notable amount tempered their responses to highlight challenges to wider adoption such as high cost and the currently niche scope of application.

Indeed, DEW technology is subject to several current engineering challenges and limitations such as high energy consumption, high development costs, technological complexity, and a reduction of effectiveness in a range of adverse environmental conditions.

Nevertheless, the slow but steady growth in the DEW market appears linked to the commensurate growth in demand for effective C-UAS solutions capable of countering the emergence of Locust on the modern battlefield.