Tanker aircraft spending is expected to see an upswing in over the next few years, with procurement rising from today’s value of $4.5bn up to peaks of $6.6bn in 2024, according to GlobalData. As various nations alter their armed forces to become more ‘expeditionary’ and mobile in posture, demand for aerial refuelling capabilities will rise to support this increased mobility, predicts Tristan Sauer, defence analyst at GlobalData.

Concerns over high intensity warfare have propelled a change in force posture, with smaller nations – particularly within the NATO alliance – looking to become less reliant on logistical support from the US Air Force by supplying their own tanker aircraft.

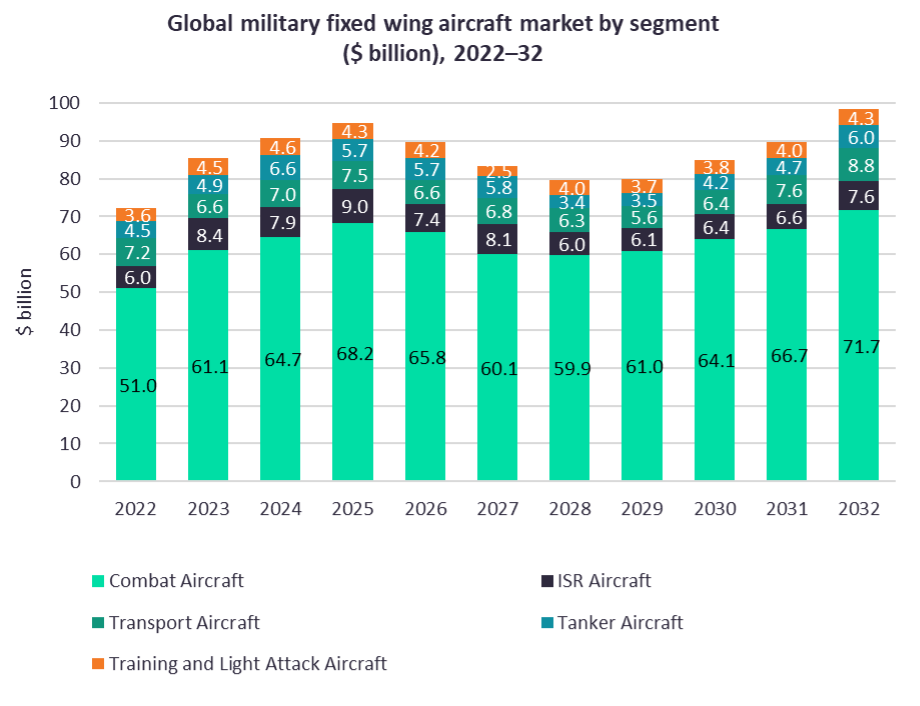

While the tanker market is predicted to grow with a 2.83% Compound Annual Growth Rate (CAGR) between 2022-2032, amounting to $55bn over that period, analysts expect an immediate jump in the next four years as the reaction to the war in Ukraine and rising budgets reinforces the original drivers.

Major investment in the sector comes from the US acquiring the Boeing KC-46A aerial refuelling tanker to replace its tanker fleet of KC-135.

France’s ongoing procurement of A330 MRTT and Russia’s procurement of IL-78M-90A dominate Europe’s share of the market, although countries including Spain, Hungary, and Germany also have significant procurement plans.

Saudi Arabia’s KC-130J and Israel’s KC-46A programs are among large drivers outside of Europe and the US, as well as the Japanese procurement of the KC-46A Pegasus tanker aircraft.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThere is limited added growth contributed by China’s H-6U tanker conversion program, while India so far has put out a Request for Proposal (RFP) for six mid-air refuelling planes. The estimated to cost to India is more than $2bn, leading to more investments towards the tanker aircraft segment in the region.

Speaking at a GlobalData’s presentation on 4 October, Key Themes Impacting the Aerospace & Defense Industry, Sauer introduced expectations for the defence industry through the period of great power competition that has emerged over the last few years.

Sauer explained: “There is a wider trend across the general defence industry to reinvigorate the procurement and development of advanced platforms and conventional warfare systems in the threat of high intensity wars.”

High intensity warfare is a state of conflict between large or geopolitically powerful factions and describes when the tempo of operations and manoeuvre warfare are used to achieve the complete physical destruction of the hostile opponents’ war-fighting capabilities.

Within the air domain, militaries around the globe are continuing to prioritise the development of next-generation combat aircraft, despite issues with the performance of air assets in the war in Ukraine, with the market for fixed wing combat aircraft expecting to increase from $51bn to $71.7bn by 2032.