Honeywell has moved to capture a cornerstone supplier to the US Navy SPY-6 naval radar capability with the acquisition of CAES Systems Holdings from private equity firm Advent International, in a deal worth approximately $1.9bn in an all-cash transaction.

According to a 20 June 2024, release from Honeywell, the deal will enhance the company’s defence technology solutions across land, sea, air and space, including new electromagnetic defence solutions for end-to-end radio frequency signal management.

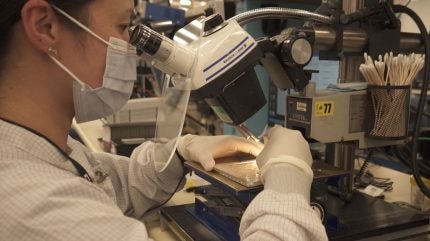

The combined company will grow the established production and upgrade positions on land and air platforms that include F-35, EA-18G, AMRAAM and GMLRS, Honeywell stated, while introducing “offerings on new platforms” like the US Navy SPY-6 radar and UAS and c-UAS technologies.

“Based on current and anticipated demand, these programmes are expected to grow significantly in the years to come, creating a favourable tailwind for revenue growth of Honeywell’s Aerospace Technologies business,” the company stated.

Cobham: former UK defence stalwart cast to the four winds

CAES Holdings is one of the businesses created by Advent International when it acquired UK-based defence company Cobham in 2020 in a £4bn ($5.6bn) takeover. At the time, Advent expressed its “long term commitment to investing in the UK” through the deal.

In 2020, Shonnel Malani, partner at Advent, said: “Advent is proud to build on our strong track record of UK investment as we take this historic company forward, on the next chapter of its development. We have strong conviction in Cobham’s businesses and look forward to delivering on each one’s full potential, for the benefit of customers, suppliers, and employees around the world.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFollowing the acquisition of Cobham, the company was split up into separate business units and delisted from the London FTSE stock exchange. Concerns were raised at the time of the acquisition that Advent would seek to break off and sell segments of Cobham.

Months after the takeover was confirmed, Draken International acquired Cobham Aviation Services in September 2020, forming Draken UK to provide aerospace and ‘red air’ training solutions for the UK Ministry of Defence.

In June 2021 US-based power management company Eaton completed the acquisition of Cobham Mission Systems for $2.8bn.

Most recently, in April 2024 European defence system provider Thales completed the purchase of Cobham Aerospace Communications for $1.1bn.