The cost-saving benefit of Directed Energy Weapons (DEWs) is among those that have been key to their first deployments, according to a new GlobalData report.

Elsewhere, unprecedented global media visibility of modern warfare, exemplified by the Russia-Ukraine war, illustrates the importance of ESG for the use of DEWs, according to the Thematic Intelligence – Directed Energy Weapons (2023). From cluster munitions to dumb bombs, there has been strong criticism of certain weapon technologies on the grounds of international human law and human rights.

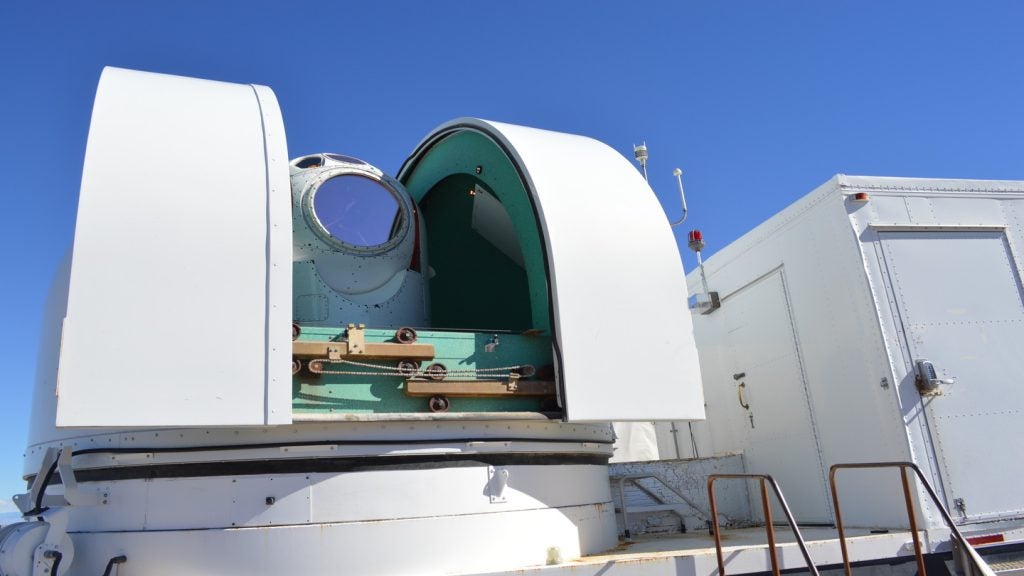

Plans for DEWs, which encompass defensive weapons systems that produce electromagnetic energy to ‘fire’ on a target such as a drone or missile, were first revealed in 1983, at the height of the Cold War.

They were announced by then-US-President Ronald Reagan at the launch of his Strategic Defence Initiative – or so-called ‘Star Wars program’ – a seemingly omnipotent if fanciful space-based laser system designed to obliterate the threat of incoming ballistic missiles.

Decades of research and development later, in 2022, DEWs were deployed for the first time in an armed conflict during Russia’s invasion of Ukraine.

DEWs offer a practical and symbolic advantage due to their reduced risk of collateral damage, low-cost (and potentially renewable) energy sources, and mitigated lethal capabilities.

Russian authorities claimed to have developed and used its own Zadira-16 model, equipped with a high-energy laser capable of destroying drones in five seconds, although this has been met with scepticism.

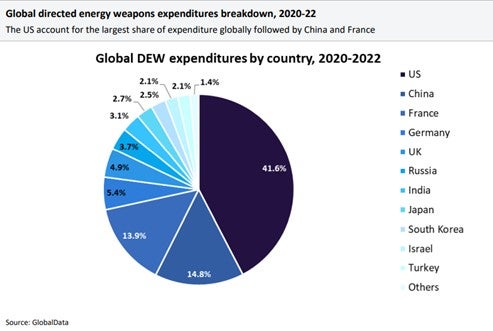

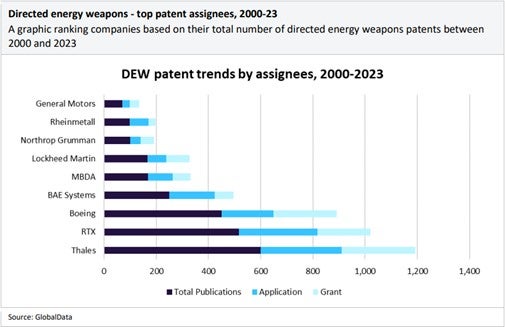

China, France, Germany, India, Israel, Turkey, South Korea, the US and UK are among nations at various stages of DEW development. The report also shows that Paris-headquartered Thales have led DEW patents over the past two decades.

“There is growing investment and demand for technical expertise within the global defense market amid concerns surrounding Counter-UAS (C-UAS) capabilities and logistical sustainability in high intensity warfare scenarios”, says Tristan Sauer, defence analyst at Global Data. “While development and engineering challenges continue to impose delays on the eventual deployment of destructive DEWs, the ongoing use of air and space DEWs foreshadows an inevitable global shift towards a more widespread use of laser-based weapons systems in armed conflict over the coming decades.”

For policymakers and military procurement officials, increases in defence expenditure have become increasingly justifiable. China, for instance, is forecasted to grow its defence budget from $225bn (1.6trn yuan) (current) to $318bn by 2027, with investment expected in its LW-30 Laser Defence Weapons System.

Amid various global geopolitical flashpoints and the interminable Russia-Ukraine war, DEW development is expected to continue as nations seek a “politically palatable” military advantage.