Aerospace and defence company Saab has unveiled its financial results for the third quarter of 2023, proving resilient in the face of evolving market dynamics marked by geopolitical tensions.

Saab highlighted growth in order intake, sales and profitability, with EBITDA (earnings before interest, taxes, depreciation and amortisation) and operating income improving.

Growth momentum in an evolving market

The headlines from Saab's Q3 2023 report emphasise the company's ability to navigate a complex and rapidly changing geopolitical landscape. President and CEO of Saab Micael Johansson pointed out that "geopolitical tensions are impacting our industry and driving the largest increase in defence investments in the last 30 years, particularly in Europe."

In the third quarter, Saab saw growth in several areas.

The order intake for Q3 2023 reached SKr14.98bn ($1.34bn), demonstrating strong growth across all order sizes. This increase, more than double the previous year's, reflects the heightened demand for Saab's defence portfolio.

Saab achieved sales growth, with revenues reaching SKr11.53bn, showcasing an organic growth rate of 31%.

The company experienced improvements in profitability, with EBITDA increasing by 28% to SKr1.42bn and an EBITDA margin of 12.4%. Operating income (EBIT) also soared by 51% to SKr859m, with an EBIT margin of 7.5%.

Net income for the period rose to SKr656m, with earnings per share amounting to SKr4.84. This represents an increase over the previous year's numbers.

The operational cash flow for the quarter was SKr-2,058m, primarily due to the timing of customer payments combined with higher investments.

Saab maintained a robust net liquidity position in the quarter, ending at SKr1.4bn, an increase from the previous year.

Saab has upgraded its outlook for organic sales growth in 2023. The company anticipates organic sales growth to be 19–23%, compared with the previous view of 16–20%.

GlobalData's geographical insights on Saab

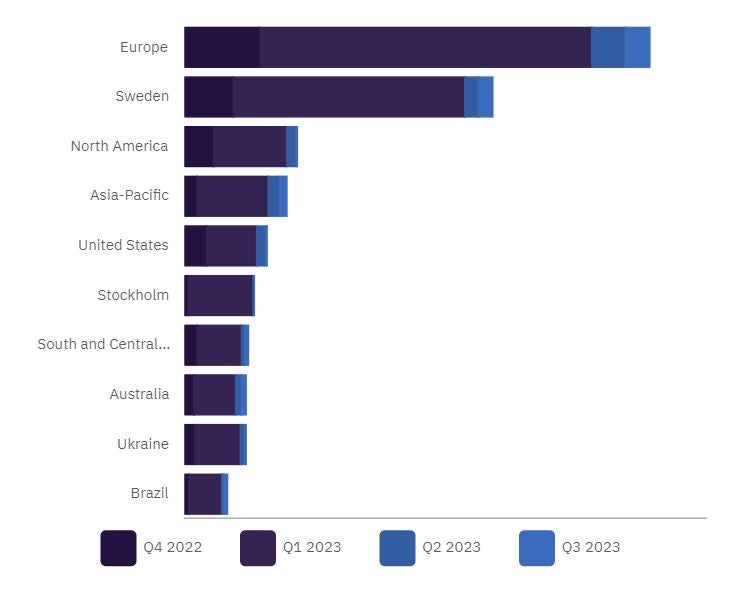

GlobalData, a leading data analytics company, provided data on Saab's geographical and thematic mentions in its filings.

GlobalData's filings data indicates a strong focus on Europe in Saab's recent filings. The mentions of Europe surged in the third quarter of 2023, with 21 references, following 285 mentions in the first quarter and 29 mentions in the second quarter. This suggests that the company is closely monitoring and adapting to the rapidly changing European defence landscape following Russia's invasion of Ukraine.

Sweden, where Saab is headquartered, also receives attention in the filings data. This indicates Saab's continuous involvement in its home market and the potential for synergies with the Swedish defence sector.

Saab demonstrated its commitment to Sweden's defence this Q3 by securing an agreement with the Swedish Defence Materiel Administration (FMV) to enhance the Gripen E and Gripen C/D fighter aircraft and by delivering the inaugural series-produced Gripen E aircraft to Sweden's FMV.

This delivery allows FMV to temporarily operate the aircraft before its transfer to the Swedish Armed Forces, ultimately leading to its deployment in 2025.

Despite relatively fewer mentions, North America remains a prominent region for Saab, with notable interest from the US. Saab's growing presence and influence in the North American defence market are evident from the continuous mentions in the filing data.

For example, Saab took a step into artificial intelligence (AI) and machine learning within the defence industry by acquiring Silicon Valley-based AI company CrowdAI.

Saab's Q3 2023 results show the company's growth in a complex global landscape marked by geopolitical tensions. The insights from GlobalData's filings data provide an understanding of Saab's strategic focus on Europe. Saab's acumen continues positioning the company as a player in the international defence and aerospace industry.

Our signals coverage is powered by GlobalData's Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.