Saudi Arabia is charting a robust course to fortify its defence capabilities in a region rife with geopolitical tensions and security challenges.

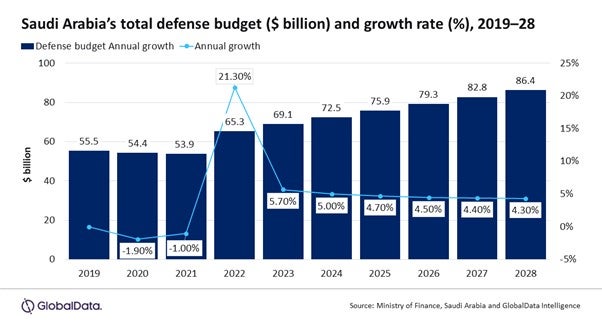

Anchored by Vision 2030, the Kingdom aims to bolster its domestic defence industry, innovate technologically, and forge strategic alliances on the global stage. GlobalData, a prominent data and analytics company, forecasts that Saudi Arabia's defence expenditure will surge with a 4.5% compound annual growth rate (CAGR) through 2024–28, reaching $86.4bn (SR3.24trn) by 2028.

This increase safeguards the Kingdom's sovereignty, protects vital assets, and positions itself as a player in the Middle East's security landscape.

Saudi Arabia's commitment to enhancing its defence capabilities is fully displayed as the Kingdom continues investing in strategic procurement programmes.

According to GlobalData's latest report, titled "Saudi Arabia Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2023-28," the Kingdom's defence budget recorded a 5.7% increase in 2023, soaring to $69.1bn.

This budgetary boost is attributed to ongoing investments in procurement initiatives, including military fixed-wing aircraft, missiles, missile defence systems, and naval vessels.

Strategic defence investments for regional security

As geopolitical tensions persist and the threat of terrorism looms in the volatile Middle East region, Saudi Arabia recognises the imperative of maintaining a robust defence expenditure.

Rouble, aerospace and defence analyst at GlobalData notes, "Saudi Arabia is located in a volatile region marked by territorial conflicts and terrorism, which necessitates a robust defence expenditure to safeguard its sovereignty and protect vital assets such as oil infrastructure."

Over the past four years, from 2019 to 2023, Saudi Arabia's defence expenditure as a percentage of its GDP averaged an impressive 7.9%.

An example of a significant import deal that Saudi Arabia has recently had involved the Saudi Arabian Defense Ministry signing an agreement for the combat drone Akinci from Turkish manufacturer Baykar, marking the largest defence deal in Turkish history and underlining Saudi Arabia's emphasis and urgency on becoming self-reliant to avoid economically benefiting allies.

Modernising aerial capabilities

Saudi Arabia's determination to bolster its defence capabilities is exemplified through procurement programs to acquire military platforms. Notable acquisitions include the Eurofighter Typhoon aircraft, the Patriot Advanced Capability-3 (PAC-3) missile system, and the modernisation of the F-15SA fleet.

Rouble emphasises, "Saudi Arabia is heavily modernising its aerial capabilities with a specific emphasis on strike platforms. The country plans to integrate a number of advanced sensors and radars into its in-service F–15 fighters and Eurofighter Typhoons over the coming years.

The integration of these advanced capabilities into its multi-role fighter aircraft would significantly enhance the country's air defence and military prowess."

Naval advancements: from brown water to green water Navy

Saudi Arabia's naval ambitions are also reaching new heights, with plans to transition from a brown water Navy to a green water Navy. Under the Saudi Naval Expansion Program II (SNEP II), the Kingdom is poised to procure a fleet of corvettes, littoral combat ships, and offshore patrol vessels.

These acquisitions aim to safeguard vital shipping routes and maritime resources, further strengthening the nation's defence capabilities.

Vision 2030: A catalyst for self-sufficiency

Vision 2030 acts as a catalyst in Saudi Arabia's pursuit of self-sufficiency in defence manufacturing. The Kingdom's ambitious goal is to localise more than half of its defence equipment needs and develop its defence industrial complex to diversify its economy and reduce the country's dependency on oil.

To achieve this objective, Saudi Arabia has been actively promoting its domestic companies to engage in joint ventures, strategic partnerships, and collaborations with international manufacturers.

As Saudi Arabia continues to invest in its defence capabilities, Vision 2030 aims to propel the Kingdom toward its goal of self-sufficiency and enhanced security in a region marked by uncertainty.