The importance of environmental, social, and governance (ESG) factors for sustainability in investment and business decisions have been accentuated by the COVID-19 pandemic.

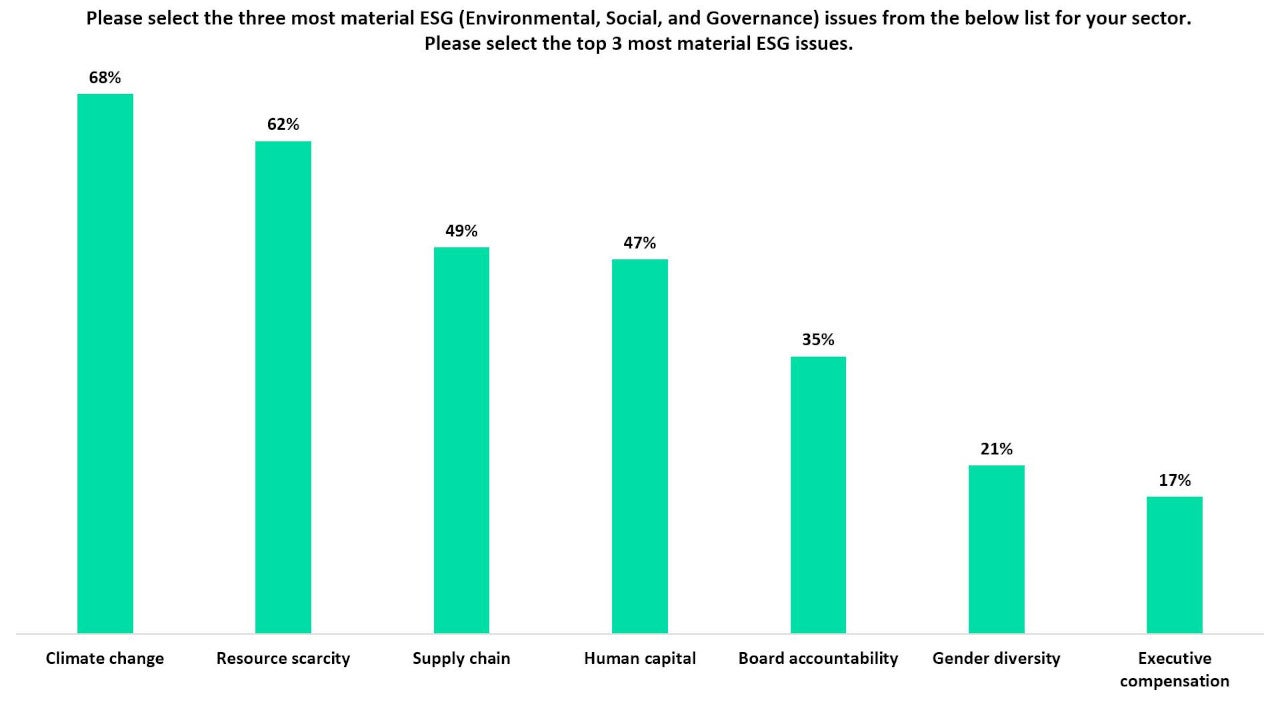

In a poll conducted by Verdict to identify the most material ESG issue, climate change was voted by a majority 68% of the respondents, followed by resource scarcity (62%) and supply chain (49%).

Human capital and board accountability received 47% and 35% votes in the poll, respectively, whereas gender diversity and executive compensation were opined by 21% and 17% of the respondents respectively as the most material ESG issue.

Human capital and board accountability received 47% and 35% votes in the poll, respectively, whereas gender diversity and executive compensation were opined by 21% and 17% of the respondents respectively as the most material ESG issue.

The analysis is based on 254 responses received from the readers of Verdict, between 01 February and 12 April 2021.

Important ESG issues in COVID-19

The impact of the COVID-19 pandemic on human lives has forced governments, businesses, and investors to reanalyse the priorities for future growth. The net inflows into ESG assets reached a record $21m in the first half of 2020, which was almost equal to the total amount generated in 2019.

COVID-19 has boosted responsible investment as the global investors are inclining towards a green, inclusive, and sustainable recovery. The global sustainable open-ended funds (mutual funds and exchange traded funds) were more preferred to the traditional ones and witnessed a 41% surge year-over-year in the first quarter of 2020, with the US sustainable funds fetching $7.3bn.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataClimate change is expected to be a focus area in ESG over the next few years, especially for industries and companies that are most affected by the pandemic. Businesses may end up paying higher costs of capital or may not be able to raise funds at all, if they do not incorporate climate change into their planning and strategy, according to BDO Global, an accounting and advisory firm.

Investors are increasingly calling for companies to ensure transparent reporting on their current and future activities that have an impact on the climate. Investors are focusing on incorporating climate data into their investment strategies, according to investment research firm Morgan Stanley Capital International’s (MSCI) 2021 Global Institutional Investor Survey. The survey found that approximately 50% of investors handling assets worth more than $200bn were four times more likely to use climate data to assess investment opportunities compared with those handling assets of less than $25bn in value.